Key Takeaways

- Gold investor Peter Schiff has publicly labeled Strategy’s Bitcoin treasury business model a “fraud” and issued a challenge to founder Michael Saylor for a public debate.

- The debate is slated to take place at Binance Blockchain Week in Dubai, UAE, in December, where Schiff intends to argue that the company’s “high-yield” preferred shares will never be paid, risking a “death spiral.”

- Schiff’s challenge comes as the crypto treasury sector faces a downturn with Bitcoin trading below $99,000, while gold successfully defends the key $4,000 per ounce support level.

Peter Schiff’s ‘Fraud’ Allegation

The perennial debate between gold and Bitcoin was reignited aggressively by gold advocate Peter Schiff, who publicly called Strategy’s corporate treasury business model a “fraud.” Schiff, one of the cryptocurrency sector’s most vocal and persistent critics, did not stop at mere criticism but issued a direct challenge to company founder Michael Saylor for a public, high-stakes debate. This highly anticipated face-off is scheduled to take place at the Binance Blockchain Week in Dubai, United Arab Emirates (UAE), in December.

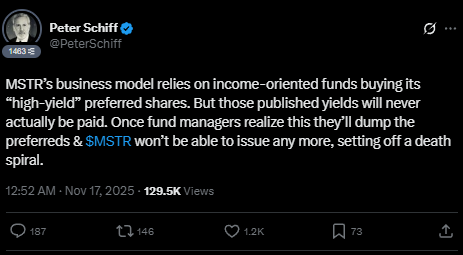

Schiff’s core argument centers on the financial mechanics Strategy uses to fund its vast Bitcoin holdings. He contends that Strategy’s model relies on income-oriented funds purchasing its “high-yield” preferred shares, but believes those published yields “will never actually be paid.”

Schiff warned in a separate X post that once fund managers realize this fundamental deception, they will “dump the preferreds.” This sell-off, according to Schiff’s analysis, would effectively block Strategy from issuing the additional debt necessary to sustain its strategy, ultimately triggering a “death spiral” for the company. He also challenged Binance co-founder Changpeng Zhao (CZ) to a debate at the same event.

Bitcoin Downturn and Gold’s Resilience

Schiff’s challenge and pessimistic forecast for the crypto sector coincide with a period of weakness in the Bitcoin market. The price of BTC has fallen over 20% from its all-time high above $125,000 reached in October. The broader crypto treasury sector has also suffered a general downturn, evidenced by the performance of Strategy’s stock.

Strategy’s key valuation metric, the multiple on net asset value (mNAV), which reflects the stock premium over its underlying Bitcoin holdings, dipped below 1 in November before modestly rebounding to 1.21. However, this is still considered low, as investors typically view an mNAV of 2 or higher as a healthy premium for a treasury company.

Strategy’s stock itself is down by over 50% since July, trading at approximately $199. In stark contrast, gold has shown impressive resilience, successfully defending the critical $4,000 per ounce psychological support level and trading currently at about $4,085 per ounce, underscoring its traditional role as a safe-haven asset amidst global market volatility.

Final Thoughts

Peter Schiff’s challenge to Michael Saylor sets the stage for a landmark debate on the financial viability of corporate Bitcoin treasuries versus traditional assets like gold. His “fraud” allegation, though disputed by Saylor’s supporters, highlights the financial risks inherent in Strategy’s debt-backed model, especially as Bitcoin’s price and the corporate treasury sector experience a period of decline.

Frequently Asked Questions

Where will the Saylor vs. Schiff debate take place?

The debate is scheduled for Binance Blockchain Week in Dubai, UAE, in December.

What is Schiff’s main argument against Strategy’s model?

He argues the model is a “fraud” because the published yields on its preferred shares will never be paid, leading to a potential “death spiral.”

How has Strategy’s stock performed recently?

Its stock is down over 50% since July, and its mNAV (premium over BTC holdings) recently dipped below 1 before rebounding slightly.