Key Takeaways

- The Central Bank of Iran (CBI) acquired over $507 million in USDT to stabilize its national currency.

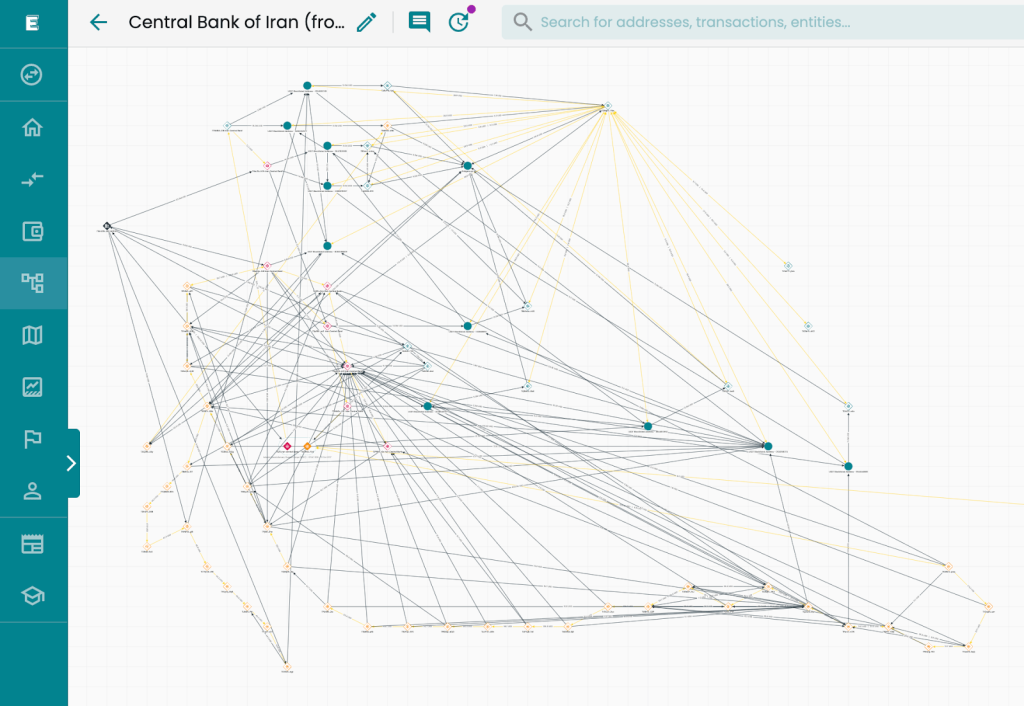

- Blockchain analytics firm Elliptic identified funds moving through the Nobitex exchange and cross-chain bridges.

- Tether has already intervened by freezing approximately $37 million linked to CBI-controlled wallets.

Elliptic Report: Iran’s $507M Secret Stablecoin Play

It looks like Iran’s central bank has been playing a high-stakes game of “financial chess” with stablecoins. According to Elliptic, the bank managed to quietly hoard over $507 million in Tether just as the Iranian rial was in a total freefall—losing half its value in just a few months. Instead of using their limited cash, the bank essentially used USDT as a “digital dollar” to buy back their own currency and stop the bleeding.

For a while, they funneled everything through Nobitex, the country’s biggest exchange. But after Nobitex got hit by a major hack in June 2025, the central bank got a lot more careful. They started jumping across different blockchains—using bridges to hop from TRON to Ethereum—to try and keep their international trade settlements under the radar. But because crypto ledgers don’t lie, researchers were still able to follow the breadcrumbs right back to the CBI.

Digital asset usage spikes in Iran amid protests

What’s happening with the Central Bank is really just part of a bigger story across the country. Between hyperinflation and civil unrest, Iran’s crypto market hit an eye-watering $7.8 billion in 2025. People aren’t just speculating; they’re using Bitcoin and USDT as a “digital bunker” to protect what’s left of their wealth. It’s put everyone—from the government to the person on the street—in the same boat, leaning on decentralized tech just to survive a closed-off economy.

But there’s a massive catch: stablecoins aren’t as “unstoppable” as people think. Back in June 2025, Tether actually froze $37 million belonging to the central bank. It’s a perfect example of the “tug-of-war” we’re seeing right now. You have governments trying to use crypto to bypass sanctions, but they’re running head-first into the centralized authorities who actually control the “on-off” buttons for those digital dollars.

Final Thoughts

Iran’s use of USDT as a sovereign financial tool proves that stablecoins are now critical infrastructure for nations facing economic isolation and currency devaluation.

Frequently Asked Questions

How did Iran use USDT?

The central bank bought rials with USDT to stabilize the exchange rate and settle international trade.

Can these funds be frozen?

Yes, Tether has already frozen $37 million linked to the CBI using its built-in blacklisting capabilities.

Which exchange was used?

Most transactions initially occurred via Nobitex before moving to cross-chain bridges.