Key Takeaways

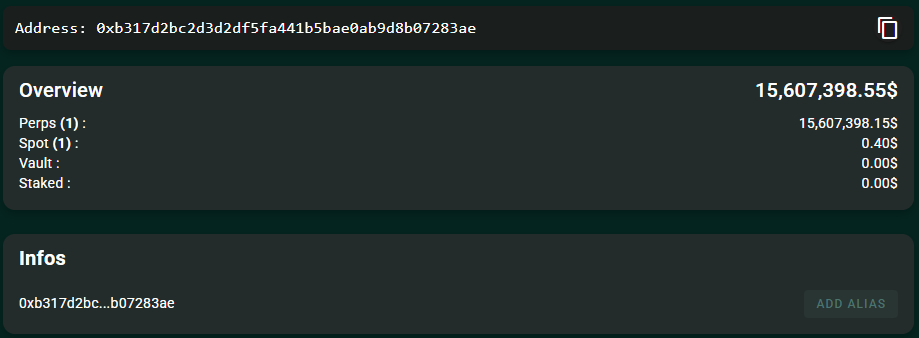

- A whale trader (0xb317) on Hyperliquid DEX, who made $192 million from a short position placed just minutes before the market crash, has opened a new $163 million leveraged short bet on Bitcoin.

- The trader (0xb317) is being widely labeled an “insider whale” due to the uncanny timing of the initial short.

- The controversy sparked debate about the integrity of unregulated crypto markets.

The most talked-about trader in crypto is back. A “whale” on the decentralized derivatives platform, Hyperliquid (associated with the wallet address 0xb317), has made a stunning reappearance by placing another huge bet against Bitcoin.

This is the same entity that, just before the market’s recent plunge following President Trump’s tariff announcement, perfectly executed a short position that netted them an eye-watering $192 million profit.

The precision of the original trade, executed only a half-hour before the bombshell news broke, was so impeccable that it immediately triggered community-wide speculation of insider trading.

Now, the whale has doubled down on their bearish conviction, opening a fresh $163 million leveraged perpetual contract to short Bitcoin. This 10x leveraged bet is massive, and while it’s currently in profit, it comes with a high-stakes liquidation line: if Bitcoin’s price climbs to $125,500, the position will be wiped out.

The big question hanging over the entire community remains: was the first trade pure genius, or did they have a cheat sheet? The timing is simply too curious to ignore.

The consensus among many onlookers is that this entity had privileged, non-public information about the presidential announcement, earning them the title of “insider whale.”

The Debate Over Market Manipulation

The sheer scale of the profits and the exact timing have done more than just create a crypto celebrity; they’ve sparked an intense and necessary debate about the integrity of our unregulated markets. The trade preceded a sell-off that resulted in over $19 billion in liquidations across the ecosystem, crushing countless leveraged traders.

Some observers even speculate that the whale’s colossal short may have been so large that it actively contributed to the “leverage flush” that crashed the market.

Critics argue that the lack of oversight makes these environments an ideal breeding ground for manipulation, insider trading, and a total lack of accountability.

As one researcher bluntly put it, this event highlights the “risk of corruption and crime without oversight” that comes with operating in an unregulated space. The Hyperliquid whale’s success is now being held up as a prime example of this systemic vulnerability.

Binance Denies Role in Market Contagion

In a related episode that only fueled the narrative of a chaotic ecosystem, the centralized exchange Binance had to deny its own role in the market meltdown.

While denying that internal issues caused the crash, Binance did acknowledge a need to compensate traders after a technical glitch and the de-pegging of certain collateral assets (like USDe) during the peak of the volatility.

The combination of a seemingly insider trade, record liquidations, and major exchanges hitting technical snags paints a vivid picture of a flawed and fragile market when the pressure is on.

Final Thoughts

The reappearance of the “insider whale” with another massive Bitcoin short intensifies the focus on the integrity of decentralized derivatives. While the whale profits, the incident serves as a clear warning about the fragility of highly leveraged, unregulated markets in the face of major, unexpected external events.

Frequently Asked Questions

What is an “insider whale”?

A term for a large trader suspected of having non-public, privileged information due to the suspicious timing of their trades, such as opening a short minutes before a major announcement.

How much profit did the trader make initially?

The whale trader realized 192 million in profits from a short position placed just before the market crashed following Trump’s tariff announcement.

What is the new trade?

The trader has opened a new 163 million 10x leveraged short position on Bitcoin on the Hyperliquid decentralized exchange.