Key Takeaways

- YZi Labs, the venture firm founded by Changpeng Zhao (CZ), has launched a $1 billion Builder Fund to accelerate development and support founders within the BNB Chain ecosystem.

- The fund announcement comes as the BNB token has reached new all-time highs, briefly becoming the third-largest cryptocurrency by market cap.

- The capital will be deployed across multiple strategic sectors including DeFi, Real-World Assets (RWA), Artificial Intelligence (AI), Decentralized Science (DeSci), payments, and wallets.

YZi Labs, the venture capital firm formerly known as Binance Labs and led by Binance co-founder Changpeng “CZ” Zhao, has announced a significant commitment to the BNB ecosystem with the launch of a new $1 billion Builder Fund.

This massive capital injection is aimed at accelerating the development of projects, specifically on the BNB Chain, and securing the network’s future as a core digital infrastructure player.

The fund’s debut coincides with a monumental period for the ecosystem’s native token, BNB, which has recently climbed to new all-time highs, briefly capturing the position of the world’s third-largest cryptocurrency by market capitalization.

YZi Labs’ Role in Ecosystem Support

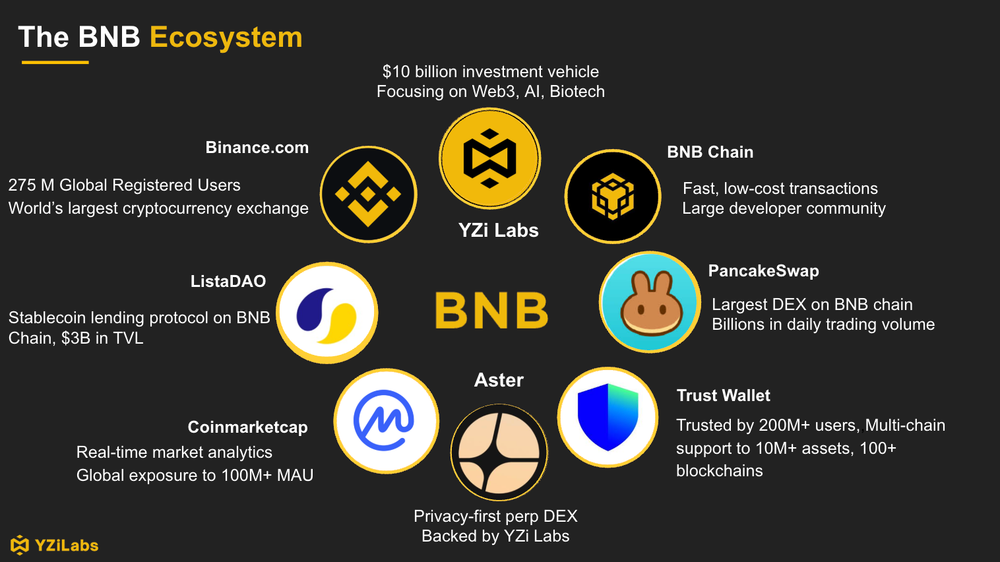

YZi Labs has a long-standing history of reinforcing the momentum within the BNB ecosystem, having previously backed major projects such as the decentralized exchange (DEX) PancakeSwap and the decentralized finance (DeFi) protocol ListaDAO. Now, as a rebranded entity, YZi Labs is deepening its commitment.

YZi Labs firm’s head, Ella Zhang, noted that the BNB ecosystem represents the “next phase of digital infrastructure,” where critical elements like on-chain scalability and decentralization are combined with security and extensive user distribution.

Beyond direct venture funding, YZi Labs has also been instrumental in advancing institutional involvement in BNB through initiatives like the BNB Yield Fund and the BNB Digital Asset Treasury.

Targeting Diverse and Strategic Sectors

The $1 billion fund is not narrowly focused; it is designed to support a wide array of builders across multiple forward-looking and essential sectors. Key areas include decentralized finance (DeFi), the burgeoning Real-World Assets (RWA) space, Artificial Intelligence (AI), decentralized science (DeSci), and crucial infrastructure like payments and wallets built on BNB Chain.

The initiative also incorporates the BNB Chain’s flagship accelerator, Most Valuable Builder (MVB), by folding it into the YZi Labs’ global Easy Residency incubation program. This unified program is designed to provide selected teams with up to $500,000 in funding, alongside direct access to core YZi Labs and BNB Chain teams, as well as a global network of mentors and partners.

The firm is actively seeking “early-stage founders building for the long term” with a clear product-market alignment, with the fund deployment beginning immediately and progressively over time.

Final Thoughts

The launch of the $1 billion YZi Labs Builder Fund is a powerful vote of confidence in the future of the BNB Chain, coming at a time when its native token is setting new records. By committing significant capital and resources to a diverse range of builders, the fund aims to cement the BNB Chain’s position as a cutting-edge platform for the next generation of decentralized applications in crucial sectors like AI and RWA.

Frequently Asked Questions

What is YZi Labs?

It is a venture capital firm founded by Changpeng Zhao (CZ), formerly known as Binance Labs, that invests in Web3, AI, and biotech projects.

What is the primary goal of the $1B Builder Fund?

To accelerate development and support founders building innovative projects and infrastructure within the BNB Chain ecosystem.

What sectors does the fund target?

The fund targets multiple sectors including DeFi, Real-World Assets (RWA), AI, DeSci, payments, and wallet solutions.