Key Takeaways

- A crypto trader predicts Ethereum could surge to $8,500 if Bitcoin reaches $150,000, based on the historical pattern of ETH’s market cap reaching up to 35% of BTC’s.

- Institutional and ETF demand for Ethereum is at an all-time high, with a record $1.01 billion in net inflows recorded in a single day for spot Ether ETFs.

- A corporate treasury adoption trend is gaining momentum, with companies like BitMine Immersion Technologies planning a $20 billion stock issuance to acquire Ethereum.

The crypto market is buzzing with bullish sentiment, and while Bitcoin’s recent push toward new all-time highs has stolen the spotlight, analysts are increasingly turning their attention to Ethereum.

According to a compelling analysis from crypto trader Yashasedu, Ether could climb to an eye-watering $8,500 if Bitcoin makes a highly anticipated move to the $150,000 mark.

The Historical Market Cap Ratio: A Blueprint for Growth

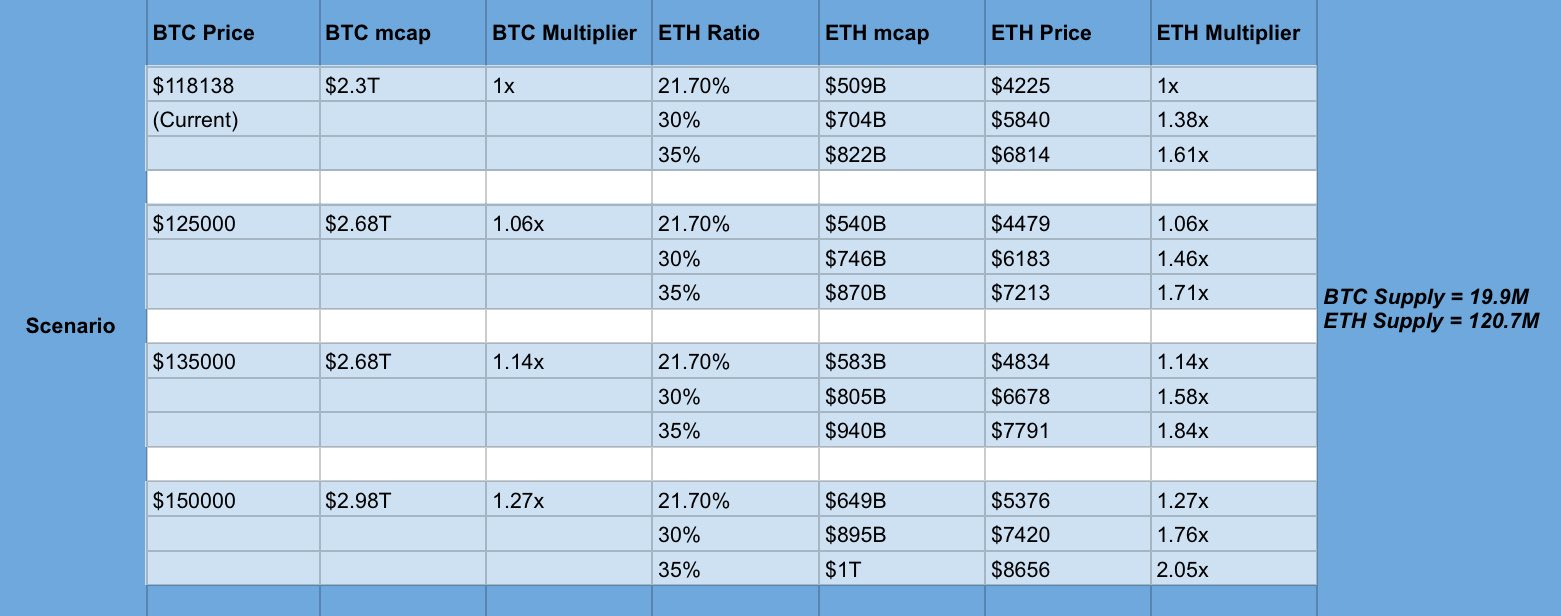

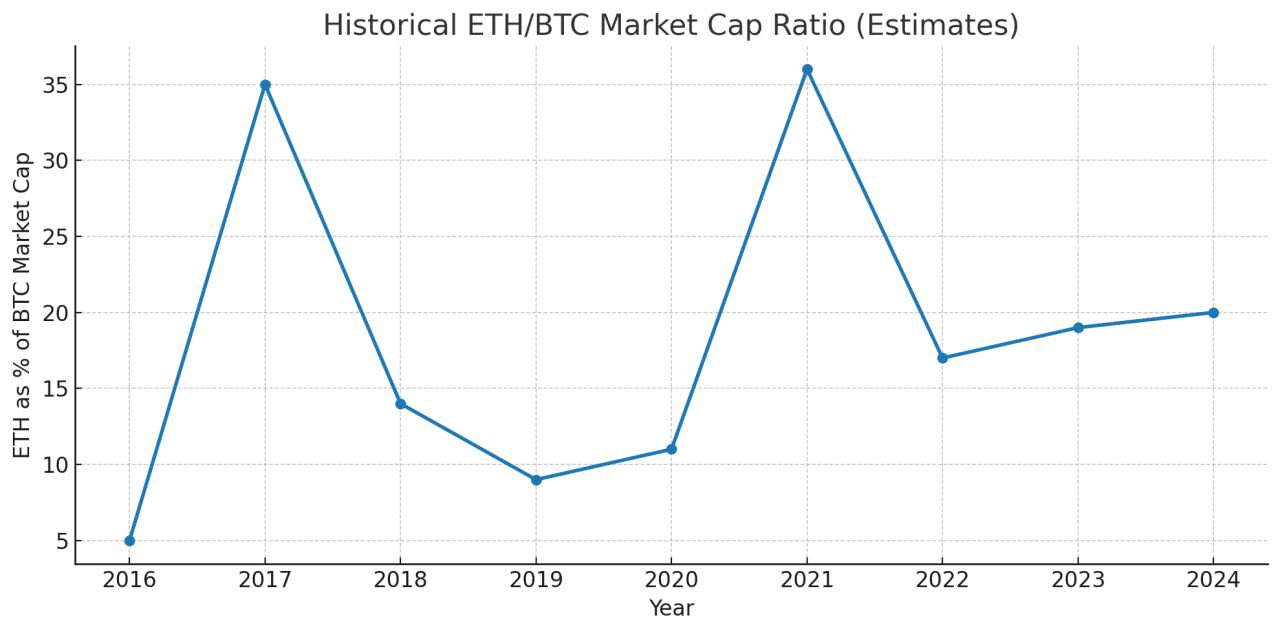

The core of Yashasedu’s prediction is a simple but powerful observation: in past major bull runs, Ethereum’s market capitalization has typically settled in the range of 30% to 35% of Bitcoin’s.

For instance, in the 2021 bull run, Ether’s market cap surged to 36% of Bitcoin’s. This pattern provides a useful blueprint for forecasting Ethereum’s potential in the current cycle.

Assuming this pattern repeats and Bitcoin reaches the $150,000 price target—a 25% increase from its current level—Yashasedu calculates that ETH could soar to $8,656.

Even a more conservative estimate, with ETH reaching the lower end of the historical range at 21.70% of Bitcoin’s market cap, would still place its price between $5,376 and $7,420.

Institutional and ETF Demand Raises the Stakes

The prediction is not a standalone theory; it’s supported by a powerful surge of institutional interest and significant capital inflows into Ethereum.

Spot Ether ETFs, which were recently approved, recorded their biggest day of net inflows ever, totaling a staggering $1.01 billion. This influx of capital from traditional finance signals a clear shift in sentiment, with institutional players now viewing Ethereum as a legitimate and highly attractive asset.

This trend is further amplified by a growing movement of corporate treasury adoption. Companies are following the playbook of firms like MicroStrategy.

However, a new wave of companies is now focusing on accumulating Ethereum. A prime example is blockchain technology firm BitMine Immersion Technologies, which announced plans to raise up to $20 billion for ETH purchases.

Ethereum’s Path to New All-Time Highs

With its current price hovering around $4,630, Ethereum is just 5.35% below its November 2021 all-time high of $4,878.

Analysts are confident that it will soon reclaim this peak. Yashasedu and other market commentators, such as MN Trading Capital founder Michaël van de Poppe, anticipate that Ether’s price will not cool off until it reaches a new all-time high.

Final Thoughts

The narrative around Ethereum is shifting from a promising technology to a powerful financial asset class.

The sheer scale of institutional inflows and corporate treasury adoption points to a future where ETH’s price movements are not just speculative but are driven by genuine utility and demand.

Frequently Asked Questions

What is the ETH/BTC market cap ratio?

The ETH/BTC market cap ratio is a metric that compares the market capitalization of Ethereum to that of Bitcoin.

Why are companies like BitMine buying Ethereum?

Companies are adopting a “crypto treasury” strategy, similar to MicroStrategy’s with Bitcoin. They are buying Ethereum to hold as a long-term asset.

What are spot Ether ETFs?

Spot Ether ETFs are investment funds that hold Ethereum directly and trade on traditional stock exchanges.