Key Takeaways

- Memecoins are joke tokens—fun but risky, often fueled by hype, not real use or strong fundamentals.

- Hype beats tech—meme energy and engagement often matter more than what the token actually does.

- Only risk what you can lose—never invest savings or key holdings in unpredictable memecoins.

Meme coins are the unpredictable side of crypto — they can change quickly, are hard to forecast, and sometimes bring big surprises. But before you spend your ETH on the next dog-themed token or frog coin, ask yourself: Is it really a good idea to jump into this?

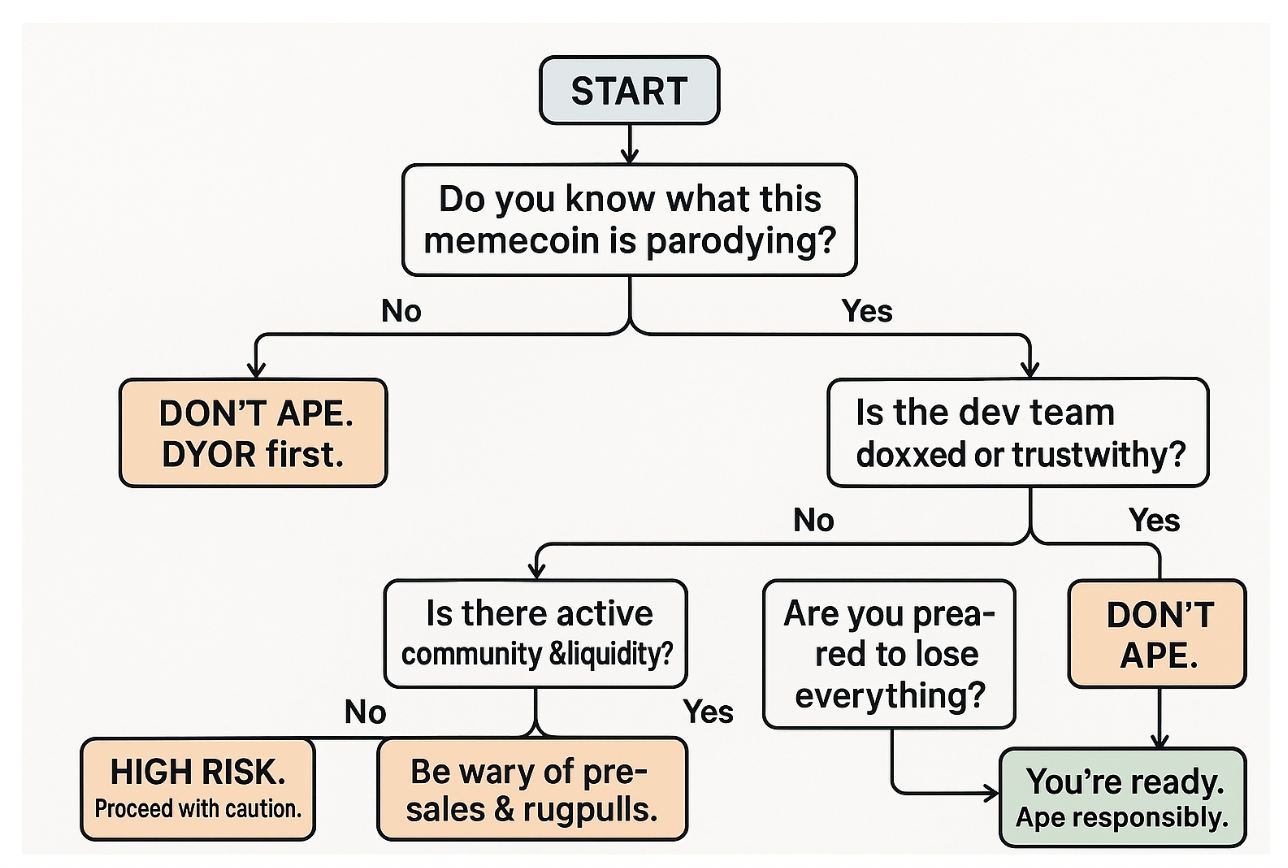

This article will help you think it through, using a flowchart and simple sections, so you know what to look at before diving into the world of meme coins.

What Is a Memecoin?

Memecoins are a type of cryptocurrency derived from internet jokes, trends, or pop culture. Well-known ones include Dogecoin, Shiba Inu, and Wojak, along with many others that are copies or variations. They often start as jokes, but some have become very popular and even worth billions of dollars. Memecoins typically gain attention through online groups, often starting as joke projects with no real function, and carry significant risks—some people earn a substantial amount, while others lose just as much.

The Flowchart: Should You Ape In?

This flowchart helps you determine if investing in a memecoin is a good idea. It starts by asking if you understand the joke or theme behind the coin. If not, it tells you to do your research first. If you do, it asks if the team behind it is known or trustworthy. If they aren’t, it checks if you’re okay with the risk of losing everything. It then asks if there is an active community and sufficient liquidity (money in the system). If not, it warns you about high risks or scams like rug pulls. If all signs look good, then you might be ready—but still, be careful.

DYOR: Always Start Here

“Do Your Own Research” isn’t just a slogan — it’s your first and most important line of defense when exploring any crypto project. With scams and poorly built tokens around every corner, taking a few minutes to verify key details can save you from major losses. Here are some essential things to look for:

Verified Contract Address

Always confirm the official contract address — either from the project’s official website or a trusted source like CoinGecko or CoinMarketCap. Scammers often deploy fake tokens with similar names.

Liquidity Lock or Burn

Verify if liquidity is locked for a significant period or burned completely. If a developer can pull the liquidity at any time, that’s a huge red flag. Tools like Unicrypt or Team Finance often show lock status.

Transparent Team or Active Community

Is the development team public and verifiable? If not, is the community active on platforms like Discord or Telegram? A ghost town or dodgy dev team with no history isn’t a good sign.

Tokenomics Breakdown

Look closely at how the token is set up. Does the price have a lot of zeros? That usually means there are a huge number of tokens, which can be misleading. Check who owns the majority of the tokens — if just a few wallets hold a large amount, that could be a risk. Be especially careful if one wallet has more than 50% of all the tokens. That much control can lead to sudden sell-offs or price changes that hurt other holders.

Red Flags You Shouldn’t Ignore

Before you jump into a memecoin, watch out for these red flags—they can signal a scam or a pump-and-dump, even if the price is going up:

- A dev wallet controls no liquidity lock or LP

- Influencers promoting it without saying they’re paid

- Telegram groups are full of bots or fake engagement

Other prominent warnings include an unverifiable smart contract or if a small number of wallets hold a significant portion of the supply. Stay sharp—don’t let hype blind you.

FOMO vs. Logic: Controlling the Urge

FOMO (fear of missing out) is what fuels many memecoins. It’s easy to think, “If I just throw in $100, I could 10x by tomorrow!” But the reality is that for every person who wins big, thousands get left holding the bag. Instead of rushing in blindly, take a step back. Wait 24 hours, track how the price moves, and see if the meme has staying power or fades quickly. Also, observe how the developers communicate. Let logic guide you—not hype.

Hype Beats Features

Most memecoins don’t have fancy technology—they rely on a strong, active community to stay alive. The hype, funny memes, and energy on Twitter/X, TikTok, or Reddit can keep a token going, even if it doesn’t actually do much. When evaluating a memecoin, look for genuine engagement, creative memes (not just copied ones), and developers who actively engage with and update the community.

How Much Should You Risk?

A simple rule to follow: never invest more than you’re willing to lose. Memecoins are highly risky and unpredictable, with prices that can crash just as fast as they rise. That’s why it’s best only to use a small portion of your crypto portfolio. This is not the place for your main ETH holdings or long-term savings. Don’t risk your key holdings—handle memecoins with care.

Know When to Exit: Leave Before the Crash

Getting into a memecoin is easy, but knowing when to exit is what protects your gains. Don’t let hype or greed keep you stuck holding a coin that’s already peaked. Here are some smart exit strategies to consider:

Set a Profit Target

Decide ahead of time when you’ll take profits, like after your money doubles or triples. Having a clear goal helps you avoid getting caught up in the hype.

Take Out Your First Investment Early

If your coin goes up, take back the money you first put in. That way, you’re only risking your gains, not your own cash.

Don’t Fall for “Moon” Talk

Memes like “we’re going to the moon” are fun, but they can trick you into holding on too long. Don’t let hype stop you from taking profits.

Watch Out for Gas Fees and Price Changes

Before buying or selling, always check the costs involved. High gas fees or price slippage can quietly eat up a significant portion of your profits. Taking a moment to review them can help you avoid surprises and keep more of what you earn.

Don’t Hold Out Too Long

Hoping for a 100x return sounds great, but it’s safer to take a solid 5x or 10x than to lose everything. Know when to take your win and leave.

Final Thoughts

Memecoins move fast and feel exciting, but they come with big risks. Most are powered by hype, not real value. Prices can soar quickly but can crash just as fast, often without warning. This makes memecoins highly unpredictable and unsuitable for most long-term investing. Always do your own research before jumping in — don’t rely only on social media buzz or FOMO (fear of missing out). Understand the project, the team behind it, and the market trends. Only use money you can afford to lose, and never invest funds meant for essentials like rent or bills.

Related Reads

Lumiterra Airdrop – How to Qualify

Revolving Games Airdrop – How to Qualify

Why Gen Z Trusts Memes More Than Media (and Maybe They’re Right)